How to Get the Best Homeowners Insurance Quote in 2025: A Comprehensive Guide

Exploring the realm of obtaining the optimal homeowners insurance quote in 2025, this guide unveils essential insights and tactics to navigate the intricate landscape of insurance offerings.

Delve into the specifics of what factors influence insurance quotes and how to leverage various strategies to secure the best rates tailored to your needs.

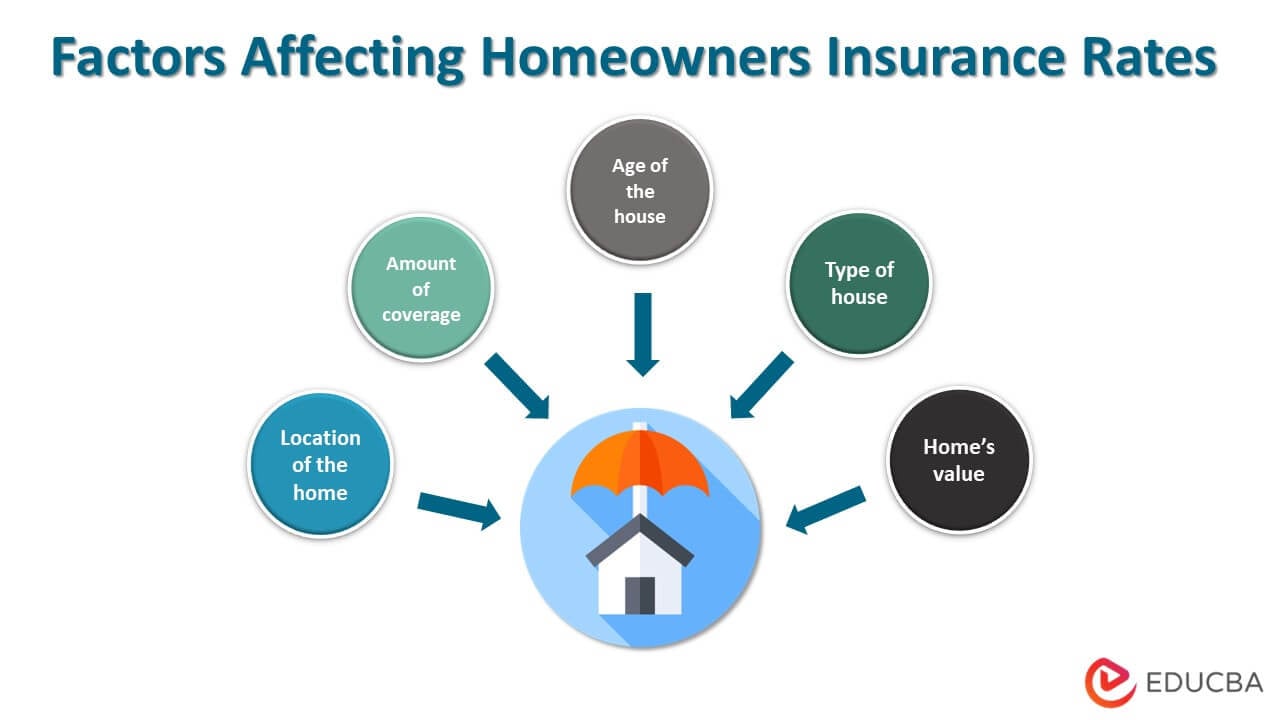

Factors Affecting Homeowners Insurance Quotes

When it comes to getting the best homeowners insurance quote, several factors come into play that can influence the cost and coverage options available to you. Understanding these factors can help you make informed decisions when shopping for insurance.

Location, home value, and coverage limits all play a significant role in determining your homeowners insurance quote. Homes located in areas prone to natural disasters or high crime rates may have higher premiums. The value of your home and the amount of coverage you choose will also impact the cost of insurance.

Credit Scores and Claims History

- Credit scores can affect your homeowners insurance premium, as individuals with higher scores are often seen as less risky to insure.

- A history of filing multiple claims can result in higher premiums, as it indicates a higher likelihood of future claims.

Types of Coverage and Additional Features

- The type of coverage you choose, such as actual cash value or replacement cost, can impact your insurance quote.

- Additional features of your home, like swimming pools or fireplaces, can increase your insurance costs due to the added risk they present.

Tips for Lowering Homeowners Insurance Premiums

When it comes to reducing your homeowners insurance premiums, there are several strategies you can implement to help lower your costs and save money in the long run. By taking proactive steps and making informed decisions, you can potentially decrease your insurance expenses while still maintaining adequate coverage for your home.

Bundling Policies

One effective way to lower your homeowners insurance premiums is by bundling your policies with the same insurance provider. By combining your home and auto insurance, for example, you may qualify for a multi-policy discount, resulting in overall savings on both policies.

Installing Security Systems

Another way to reduce your insurance costs is by installing security systems in your home, such as burglar alarms, smoke detectors, or surveillance cameras. These security measures can help lower the risk of theft or damage, making you eligible for discounts on your homeowners insurance premiums.

Raising Deductibles

Consider raising your deductibles to lower your homeowners insurance premiums. While this means you'll have to pay more out of pocket in the event of a claim, it can significantly reduce your monthly insurance costs. Just make sure you have enough savings to cover the higher deductible if needed.

Maintaining a Good Credit Score

Having a good credit score can also positively impact your homeowners insurance premiums. Insurers often use credit information to determine rates, so maintaining a strong credit score can help you secure lower premiums and better coverage options.

Avoiding Filing Small Claims

Try to avoid filing small claims whenever possible, as multiple claims can increase your insurance premiums. Instead, consider paying for minor repairs out of pocket to keep your claims history clean and prevent unnecessary rate hikes.

Reviewing Coverage Annually

It's essential to review your homeowners insurance coverage annually to ensure you're not overpaying for unnecessary coverage. By reassessing your policy and making adjustments as needed, you can potentially lower your premiums without sacrificing vital protection for your home.

Shopping Around and Comparing Quotes

Don't settle for the first homeowners insurance quote you receive. Take the time to shop around and compare quotes from different insurers to find the best rates. Ask about available discounts, special offers, and customized coverage options to maximize your savings while securing adequate protection for your home.

Understanding Coverage Options in 2025

In 2025, homeowners have access to a variety of coverage options to protect their property and assets. Understanding these options is crucial to ensure adequate protection in case of unexpected events.Dwelling Coverage:Dwelling coverage is essential and typically covers the physical structure of your home in case of damage from covered perils like fire, wind, or vandalism.

It is important to ensure that the coverage amount is enough to rebuild your home if it is completely destroyed.Personal Property Coverage:Personal property coverage helps protect your belongings inside the home, such as furniture, electronics, and clothing. It is essential to take inventory of your possessions and choose a coverage limit that adequately reflects their value

It can help cover legal expenses and potential settlements. It is important to have sufficient liability coverage to protect your assets.Additional Living Expenses Coverage:Additional living expenses coverage can help cover the cost of temporary housing and living expenses if your home becomes uninhabitable due to a covered loss.

This coverage can provide peace of mind during a challenging time.Emerging Trends in Coverage:

Cyber Insurance

With the rise of cyber threats, cyber insurance can help protect homeowners from cyberattacks, data breaches, and identity theft.

Green Upgrades Coverage

This coverage option encourages homeowners to make eco-friendly upgrades to their homes by providing coverage for sustainable materials and energy-efficient systems.

Smart Home Technology Protection

As smart home technology becomes more prevalent, insurance companies may offer coverage to protect these devices from damage or cyber threats.Reading Policy Details and Understanding Exclusions:It is crucial to carefully read your policy details to understand what is covered and excluded.

Knowing the exclusions can help you avoid surprises when filing a claim. Consider adding endorsements or riders to tailor your coverage to specific needs, such as adding flood insurance if you live in a flood-prone area.

Utilizing Technology for Insurance Quotes

AI and big data are revolutionizing the insurance industry, streamlining the process of obtaining accurate quotes quickly and efficiently. Virtual inspections, online quote tools, and mobile apps play a pivotal role in simplifying the insurance quote process for homeowners. Additionally, blockchain technology is enhancing security and transparency in insurance transactions, potentially impacting insurance quotes in 2025.

Role of AI and Big Data

AI algorithms analyze vast amounts of data to assess risk factors and calculate personalized insurance quotes for homeowners. By leveraging big data, insurance companies can offer more tailored and competitive pricing based on individual circumstances.

Virtual Inspections and Online Tools

Virtual inspections allow homeowners to provide detailed information about their property remotely, enabling insurers to assess risks accurately. Online quote tools streamline the application process, providing instant quotes based on the information provided by the homeowner.

Mobile Apps for Insurance Quotes

Mobile apps offer convenience and accessibility, allowing homeowners to manage their insurance policies, file claims, and request quotes on the go. These apps provide a seamless user experience and empower homeowners to stay informed about their coverage options.

Blockchain Technology in Insurance

Blockchain technology enhances security by creating tamper-proof records of transactions and policies. This increased transparency reduces the risk of fraud and ensures that insurance quotes are based on accurate information. As blockchain technology becomes more widespread, it is likely to have a significant impact on insurance transactions and quotes in 2025.

Summary

As we wrap up this exploration on homeowners insurance quotes in 2025, remember to apply the newfound knowledge to make informed decisions that safeguard your home and finances effectively.

Popular Questions

What factors can impact homeowners insurance quotes?

Factors such as location, home value, coverage limits, credit scores, claims history, and additional features like swimming pools or fireplaces can all influence insurance quotes.

How can I lower homeowners insurance premiums?

You can reduce insurance costs by bundling policies, installing security systems, raising deductibles, maintaining a good credit score, avoiding small claims, reviewing coverage annually, shopping around, comparing quotes, and seeking available discounts.

What coverage options are available in 2025?

Common coverage types include dwelling, personal property, liability, and additional living expenses. Emerging trends include cyber insurance, green upgrades coverage, and smart home technology protection.

How is technology changing insurance quotes?

AI, big data, virtual inspections, online tools, mobile apps, and blockchain technology are revolutionizing the insurance industry, making it easier for homeowners to obtain accurate quotes and enhancing security and transparency in transactions.